Outstanding Investor Relations Awards 2017 & 2020

| SET Symbol | RS |

| Last Done | 12.40 THB |

| Change | -0.20 |

| % Change | -1.59% |

| Volume | 4,196,940 |

| Day's Range | 12.00 - 12.60 |

| 52 Weeks' Range | 12.40 - 15.20 |

| Updated | 19 Apr 2024 15:59 |

You are in search of

Home

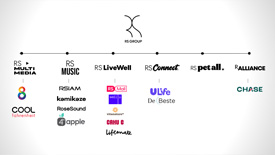

Leading Company in Thai Commerce Sector

Driven by our uniquely-pioneered “Entertainmerce” model to expand ecosystem with strong support from entertainment business

Experienced Management Team

CEO with life-time commitment to lead RS group to the new S Curve, together with high-experienced management team to drive sustainable growth

Technology Driving Growth Opportunities

Focus on data analytics to improve efficiency of marketing campaigns and raise re-purchase rate

Product Excellence

Diversify product variety and expand sales channels to reach untapped targets

Strong Financial Position

Our strong financial position provides flexibility to grow following strategies and seize new business opportunities

Creating Synergy through Partnership

Collaborate with potential partners through the M&A and JV to expand our ecosystem and “Entertainmerce” model